Those "overlays" can avoid you from loaning, but other banks may use various guidelines. It's another reason that it pays to go shopping aroundyou requirement to find a lending institution with competitive expenses, and you need to discover a lender who will accommodate your requirements. Buying a house might be the largest financial investment you make in your life, however manufactured homes are normally more economical than site-built houses. They can make own a home available, especially for customers with lower incomes and those who reside in rural areas where contractors and materials are not readily available.

Produced houses are a clever option for homeowners trying to find a recently developed modern home with an affordable mortgage payment. While the term "mobile home" is still used widely, these single, double and triple-wide prefabricated homes can you deduct timeshare maintenance fees are now referred to as produced homes. Funding a made house or any other kind of home is challenging, but it can be particularly difficult for a new homeowner. A 20% deposit is no longer typical. Lots of public and private companies help buyers who have less than 5% of a house's price to put down. There are many responsibilities of owning a house that brand-new purchasers need to be familiar with, and they apply to manufactured homes too.

The most significant cost, naturally, will be buying and financing a mobile or manufactured home. Funding is various than for a basic mortgage, however numerous programs can make it easier to certify. The most significant distinction is that loans for mobile and manufactured homes are just for the home itself, not the land it sits upon. The park or community owns the land and leases it to homeowners. Called a belongings loan, it's a home-only loan and is technically not a property loan. It's a personal effects loan, and is likewise readily available if you already own the land and need to borrow money to buy the physical home.

In truth, it can be a lot easier to get financing for a manufactured house than for a standard frame or block home. Financing terms depend on the loan provider, however the minimum credit ratings for the alternatives we discuss below range from 580-650. Scores greater than 650 may get https://www.globenewswire.com/news-release/2020/04/23/2021107/0/en/WESLEY-FINANCIAL-GROUP-REAP-AWARDS-FOR-WORKPLACE-EXCELLENCE.html a little much better terms. Scores lower than 580 may not receive a loan at all. Chattel loans for manufactured homes are frequently smaller than basic house loans because you're not purchasing the land. This can make financing much easier for some individuals due to the fact that they're obtaining less money. Nevertheless, the repayment durations are shorter 15 or 20 years which might lead to greater monthly payments.

Another downside is that interest rates can be higher on effects loans. A study by the Customer Financial Security Bureau discovered that the interest rate, or APR, was 1. 5% greater on goods loans than basic mortgages. Loan processing fees, however, were 40-50% lower. If you're thinking about buying a made, mobile or modular home, it is very important to understand the differences between them. Pricing choices differ, as do how they're developed and installed, and safety requirements required in their construction, among other things. Some loans might be much easier to get for some kinds of these houses. Factory-built houses made prior to June 15, 1976, before guidelines needed particular security requirements.

Factory-built after June 15, 1976 and subject to federal safety requirements embeded in 1974, described as the whats timeshare HUD Code. Manufactured homes are developed on an irreversible metal chassis and can be moved after installation, but that can hinder financing. These factory-built houses are put together on-site. They should satisfy the same regional building regulations as site-built houses. They're typically installed on a concrete foundation. Loans are typically easier to get for modular homes since they hold their value and appreciate more than the other two. When you have actually chosen what type of made home you desire, you'll require to figure out how to fund it.

Renting land could make you eligible for fewer loans. Purchasing a double-wide house that costs $100,000 or more isn't allowed an FHA loan. Maximum loan quantities vary by the type of house purchased. Not just must you compare the kind of loan, however see how costs and rate of interest vary amongst lenders. Here are four broad financing options: If you own the land under your manufactured home, you remain in luck. Banks, credit unions and other lenders generally require you to own the land in order to get a home mortgage. In this case, financing a manufactured house is relatively comparable to financing a conventional house.

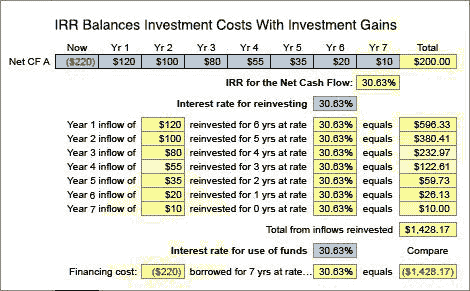

How What Is Internal Rate Of Return In Finance can Save You Time, Stress, and Money.

5% with an FHA loan), and income that is roughly three times the home loan. If you don't think you have the minimum credit rating needed, you can begin working to enhance your credit report. Online credit therapy from In, Charge Financial obligation Solutions can assist. In, Charge is a nonprofit credit therapy company that provides a complimentary snapshot of your credit report. It can help you come up with a payment strategy such as a debt management program. In addition to enhancing your credit history, owning the land you wish to put a manufactured home on can make being authorized for a loan much easier.

If you don't prepare on acquiring land for your produced house, you can still finance the purchase with a bank or cooperative credit union lender, or perhaps through help from the federal government. These programs are created to assist customers get mortgages on manufactured houses, which account for 6% of the U.S. real estate market. That's almost 8 million homes. Real estate assistance programs started in the New Offer period (1930s) when the federal government desired to provide much better houses for the rural population. The programs were administered by the USDA since the programs were geared towards on-farm real estate. The finest aspect of a USDA loan (likewise called a Rural Advancement loan) is that there is no down payment needed.

Your home must satisfy geographical requirements, but that doesn't suggest you have to live 20 miles from your nearby next-door neighbor. About 97% of the U.S. land mass is USDA loan eligible, a location encompassing 109 million individuals. Rates of interest fluctuate with the marketplace but are usually less than standard loans. The downside to a USDA loan is a Guarantee Charge of 2% is contributed to the total loan quantity, and a yearly charge of. 5% gets added to your monthly payment. The minimum credit score to certify is 640. What is a cd in finance. And unlike conventional home loans, you can be disqualified for making too much cash.

Contact your bank or credit union to see if they can assist you with a USDA loan application for a produced loan. No deposit needed Can fund 100% of appraised value Minimum credit history needed: 650 Need to fulfill geographical requirement: rural area Can't make 115% or more of county's mean income Fees: 2% cost included to the overall loan, and. 5% to regular monthly payment If you surpass the USDA's earnings limitation, you should think about an FHA loan as they have no wage optimums. The FHA doesn't actually give you cash for a home mortgage. It insures the loan, which entices lenders to fund home mortgages since they are backed by the government.